Vietnamese pig farmers hard hit by imported meat

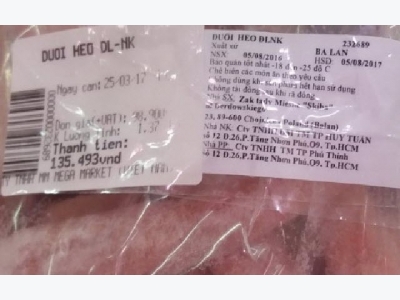

Pig tails imported from Poland are seen on sale at a supermarket in Hanoi.

Vietnamese pig farmers have been hit by the double whammy of slumping domestic pork prices and rising imports of cheap meat.

In the year to March 15, Vietnam spent more than US$9.4 million importing nearly 7,800 metric tons of pork of all kinds, a 15.8 percent increase in volume and 21.2 percent rise in value, according to preliminary customs data.

Fresh and frozen pork accounted for 2,400 metric tons in volume and $4.5 million in value respectively.

The imported meat varied from the common cuts of loin and ham to spare ribs from Canada, hearts from Spain and feet and tails from Poland, according to import data reviewed by Tuoi Tre (Youth) newspaper.

In 2016, the Southeast Asian country spent as much as $139,000 on 94 metric tons of imported pig tails.

In 2017, Vietnam’s pork production is expected to top 3.7 metric tons, up 3.2 percent on last year’s number.

However, local pig farmers are being hit by slumping pork prices as China, traditionally Vietnam’s biggest customer, has recently cut imports.

The situation is worsened by the rising demand for frozen meat imports, according to the agriculture ministry.

Live pigs are sold for VND23,000 ($1.03) a kg, while imported pork costs only VND27,000 ($1.21) per kg on average.

Vietnam is also importing huge quantities of poultry and cattle meat, according to statistics covering the first three months of this year.

The country's chicken imports were worth $19 million over the three-month period, constituting 20,600 metric tons out of a total of 41,000 tons of imports of meat of all kinds.

The country also spent $35 million on 11,800 metric tons of cattle meat during the first quarter.

Related news

New technology ups rice value in Cần Thơ

New technology ups rice value in Cần Thơ The installation of automated processing lines in a major rice mill is set to boost hi-tech marking in Cần Thơ City, officials say.

Sharp rise in Q1 fertiliser imports

Sharp rise in Q1 fertiliser imports Việt Nam spent US$338 million to import 1.22 million tonnes of fertiliser in the first quarter of this year, up 31.5 per cent in volume and around 24 per cent

Lifting of farmland limit to spur exports of produce

Lifting of farmland limit to spur exports of produce Expansion of land limits and accumulation of land for large-scale production are expected to be the foundation for the branding of farm produce.